Concerned that your financial strategy is missing something?

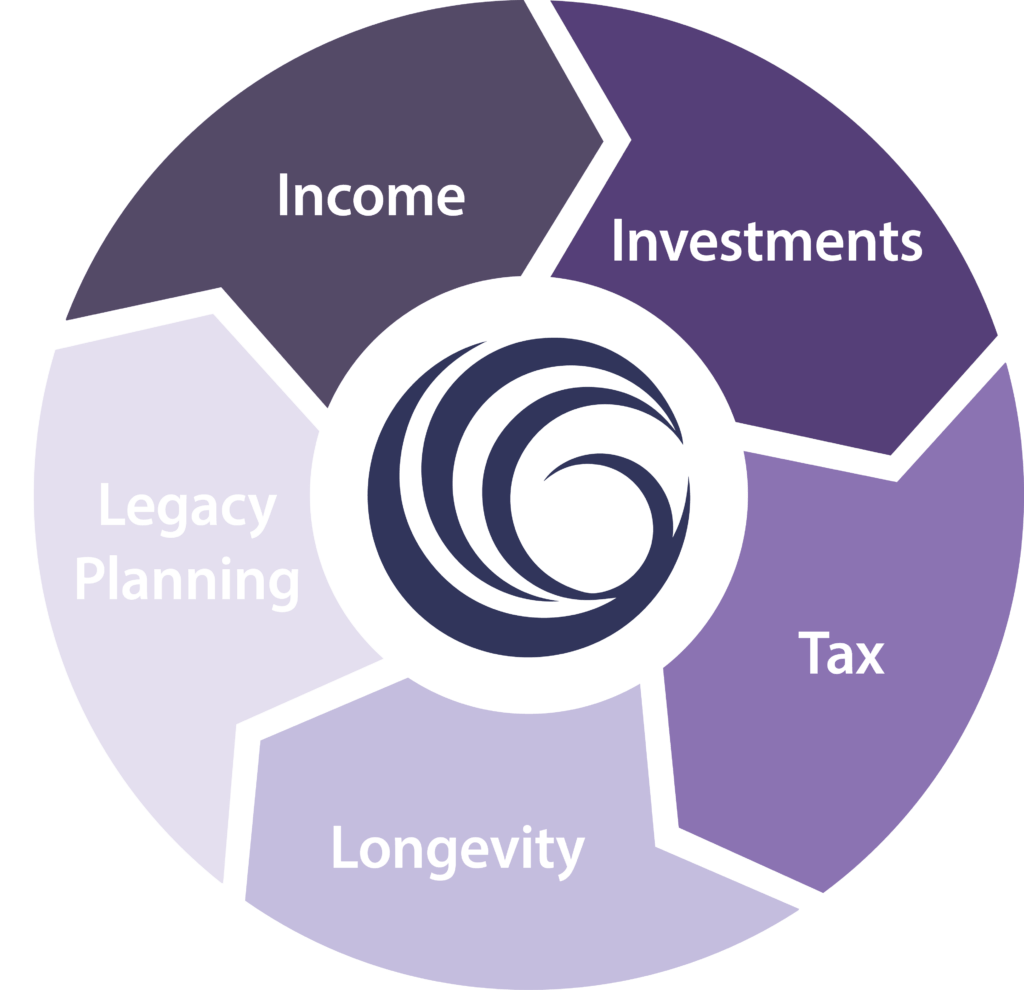

Our SOAR Process helps creates a Panoramic Financial Overview allowing you to have confidence and enjoy your life.

Financial Flight Plan

Our Financial Flight Plan helps you see the skies ahead and avoid any potential turbulence you may encounter along the way. Patrick and Kristi are proud to act as your experienced crew for the journey ahead. If you’re ready to begin charting your own Financial Flight Plan, follow our three-step itinerary below:

Our Itinerary

Phase I: The Journey Begins

We will gather all the information we need to learn about you, what is important to you and what your retirement dreams are. This helps us manage overall risk, expand your nest egg and provide a complete Financial Flight Plan. We can also answer any questions you may have about your finances or retirement planning.

Phase II: Flight Plan

We will get to work on evaluating alternatives to help manage overall risk to your Financial Flight Plan and help optimize it by creating strategies geared toward growth, reducing taxes and suggesting efficient methods for a smooth transfer of your legacy to your beneficiaries. By partnering with tax and legal professionals, we’ll help you avoid potential excess taxes or probate. In addition, we will provide the recommendations needed to address your unique situation and outline an appropriate course of action to help increase your confidence in your plan.

Phase III: The Smooth Landing

The primary objective of this phase is to implement your Financial Flight Plan. By means of constant communication and a highly skilled staff, we strive to make this process quick and easy for you. We monitor our clients’ accounts on a regular basis to help ensure they are still performing in a way that meets their intention. When we discover a client's circumstances have changed, or that shifting global markets may require a different financial approach, we are quick to make the proper adjustments.

Landing Financial Group, Inc. has a strategic partnership with tax professionals and attorneys who can provide tax and/or legal advice.

All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Any statements referring to grow your income are not a guarantee or prediction of future performance. Any references to protection benefits, guarantees or lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity product guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified tax professional for guidance before making any purchasing decisions.

Any and all other services related to insurance are an outside business activity and are not offered through or supervised by AE Wealth Management, LLC.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.